AYB 339 ACCOUNTANCY CAPSTONE INTEGRATED CASE STUDY ASSESSMENT

AYB 339 Accountancy Capstone Integrated Case Study

ASSESSMENT REQUIREMENTS FOR EACH PART

PART 1: Self-Reflection (10 Marks)

There is little doubt that COVID-19 has had a substantial impact on the way that this unit (and other units at QUT) have run this semester. For the first four weeks, students experienced how this unit is run in a face-to-face environment. However, from Week 4 onwards, discussion forums were moved to an online format.

This reflection asks students to self-reflect on the impact that COVID-19 has had on their studies in this unit, particularly given the large degree of groupwork involved.

Required:

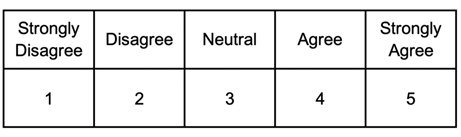

Using the 5-point Likert scale provided below, students are asked to rank their answers to each of following five questions on a scale from 1 to 5. Please write a brief explanation underneath each score as to why you awarded that particular score.

The five (5) questions are:

- I found the online discussions appropriately simulated face-to-face meetings and did not effect my communication with my peers and the facilitator.

- I now feel better prepared for working remotely and collaborating with clients and colleagues in the future.

- I would be comfortable and confident completing further education (CA, CPA, Masters etc.) in an online environment.

- Overall, I felt I was not disadvantaged by doing this unit this semester in an online format, rather in other semesters where the unit is run face-to-face.

- If I was offered a choice of face-to-face discussion forums or online discussion forums going forward, I would opt for face-to-face classes.

Your writing should be in the first person, that is, you should write your explanations with “In my opinion …”, or “I believe that …” This is very important as this assessment is a self-reflection so you must express your critical views and opinions on these issues.

You must use 11 point Arial font with 1.5 line spacing. Make sure each of your responses are clearly labelled. The maximum number of words is 1,000..

[Total for Part 1 = 10 marks]

PART 2: Enter Year-End Adjusting Journal Entries into MYOB & Print out a revised Profit and Loss Statement and Balance Sheet from MYOB – in pdf format (8 Marks)

A). Students are required to prepare and enter adjusting general journal entries directly into the MYOB data file to take into account all of the relevant and necessary adjustments (please include cents in all of your journal entries).

The MYOB data file is available on the AYB 339 Blackboard site for students to download. The MYOB data file was created using MYOB AccountRight Enterprise (Educational Version 19). This version of MYOB is available in the student labs in both B and Z blocks.

However, students can use any version of MYOB to open the data file and make adjustments (provided it is version 19 or higher).

It will not be possible to open this MYOB data file if you use the MYOB trial versions available on the MYOB website or any version of MYOB lower than this version.

The data file has been created in MYOB 19 for Windows. However, for those students who have an Apple Mac computer or laptop, the data file will be able to be converted and opened in Mac AccountEdge Pro. For those students who do not have MYOB loaded onto their Apple computer, we have provided the link to a compressed zip file containing the appropriate software to enable you to load Mac AccountEdge Pro v15.5 on your home or laptop computer.

Place an order with us to get a customized paper similar to this or any related topic. NB: The assignment will be done from scratch and it

will be 100% original